Rmd Rules 2024 2024 Married Filing. Calculations are based on rmds for tax years 2024 and beyond and assume a married couple with $250,000 in combined taxable income and $2.5 million in. That means your rmd for 2024 could be higher than it was in 2023.

Avoid penalties by filing your tax return on time and paying any tax due by the filing deadline. That means your rmd for 2024 could be higher than it was in 2023.

The Rules Are Still Complicated For A Few Reasons.

Once you've reached age 73, the qcd amount counts toward your rmd for the year, up to an annual maximum of $105,000 per individual, or $210,000 for a married couple filing.

The Modifications To The Required Minimum Distribution (Rmd) Regulations For Retirement Accounts, Including 401 (K)S, Traditional Iras, Sep Iras, And Inherited Roth Iras In.

Avoid penalties by filing your tax return on time and paying any tax due by the filing deadline.

Rmd Rules 2024 2024 Married Filing Images References :

Source: leonaniewfidela.pages.dev

Source: leonaniewfidela.pages.dev

2024 Married Filing Jointly Brackets Addy Lizzie, Last updated 3 may 2024. The final regulations reflect changes made.

Source: jaimeqelfrida.pages.dev

Source: jaimeqelfrida.pages.dev

Rmd Table 2024 Inherited Ira Marlo Shantee, The deadline to file your 2023 tax return will be april 15, 2024. Washington — the department of the treasury and the internal revenue service today issued final regulations updating the required minimum distribution (rmd) rules.

Source: rubiamarysa.pages.dev

Source: rubiamarysa.pages.dev

Rmd Table 2024 By Age Lee Verina, Once you've reached age 73, the qcd amount counts toward your rmd for the year, up to an annual maximum of $105,000 per individual, or $210,000 for a married couple filing. The deadline to file your 2023 tax return will be april 15, 2024.

Source: ddeneqsharon.pages.dev

Source: ddeneqsharon.pages.dev

Rmd Tables 2024 Corny Laetitia, Never one to make things easy, the irs has proposed regulations (from february 2022) that added a second requirement for beneficiaries who inherit iras from. In 2024, individuals aged 70 1/2 and older can channel up to $105,000 directly from their iras to qualified charities, a leap from the previous $100,000 cap.

Source: alizaqgenevra.pages.dev

Source: alizaqgenevra.pages.dev

Tax Brackets 2024 Single Vs Married Row Hedvige, That's an individual cap, so a married couple could distribute. The secure 2.0 act, signed into law in december 2022, has introduced significant changes to rmd rules, impacting retirees and those planning for retirement.

Source: ddeneqsharon.pages.dev

Source: ddeneqsharon.pages.dev

Rmd Tables 2024 Corny Laetitia, Rmd rules have previously applied to roth 401(k) plans, but only up until the end of 2023. The limit is $22,320 in 2024.

Source: ranicewjanine.pages.dev

Source: ranicewjanine.pages.dev

2024 Tax Brackets Married Filing Jointly Irs Dyana Cristal, Avoid penalties by filing your tax return on time and paying any tax due by the filing deadline. For 2024, the federal estate tax threshold is $13.61 million for individuals, which means married couples don’t have.

Source: hannabnicola.pages.dev

Source: hannabnicola.pages.dev

New Rmd Table For 2024 Schedule Printable Gisele Gabriela, Calculations are based on rmds for tax years 2024 and beyond and assume a married couple with $250,000 in combined taxable income and $2.5 million in. For 2024, you can distribute up to $105,000 (up from $100,000 previously) from your ira to charities.

_Table.png?width=1578&name=IRA_Required_Minimum_Distribution_(RMD)_Table.png) Source: annadianewanthia.pages.dev

Source: annadianewanthia.pages.dev

Calculate My Rmd For 2024 Rey Lenore, The secure 2.0 act, signed into law. For 2024, the federal estate tax threshold is $13.61 million for individuals, which means married couples don’t have.

Source: ronnaqarabella.pages.dev

Source: ronnaqarabella.pages.dev

2024 Tax Tables Married Filing Jointly Single Member Hanny Goldarina, The final regulations reflect changes made. Last updated 28 february 2024.

When You Reach Age 73 (Age 70½ If You Attained Age 70½ Before 2020), You'll Be Required To Withdraw At Least A Certain Amount (Called Your Required Minimum Distribution, Or.

The rules are still complicated for a few reasons.

For 2024, The Federal Estate Tax Threshold Is $13.61 Million For Individuals, Which Means Married Couples Don’t Have.

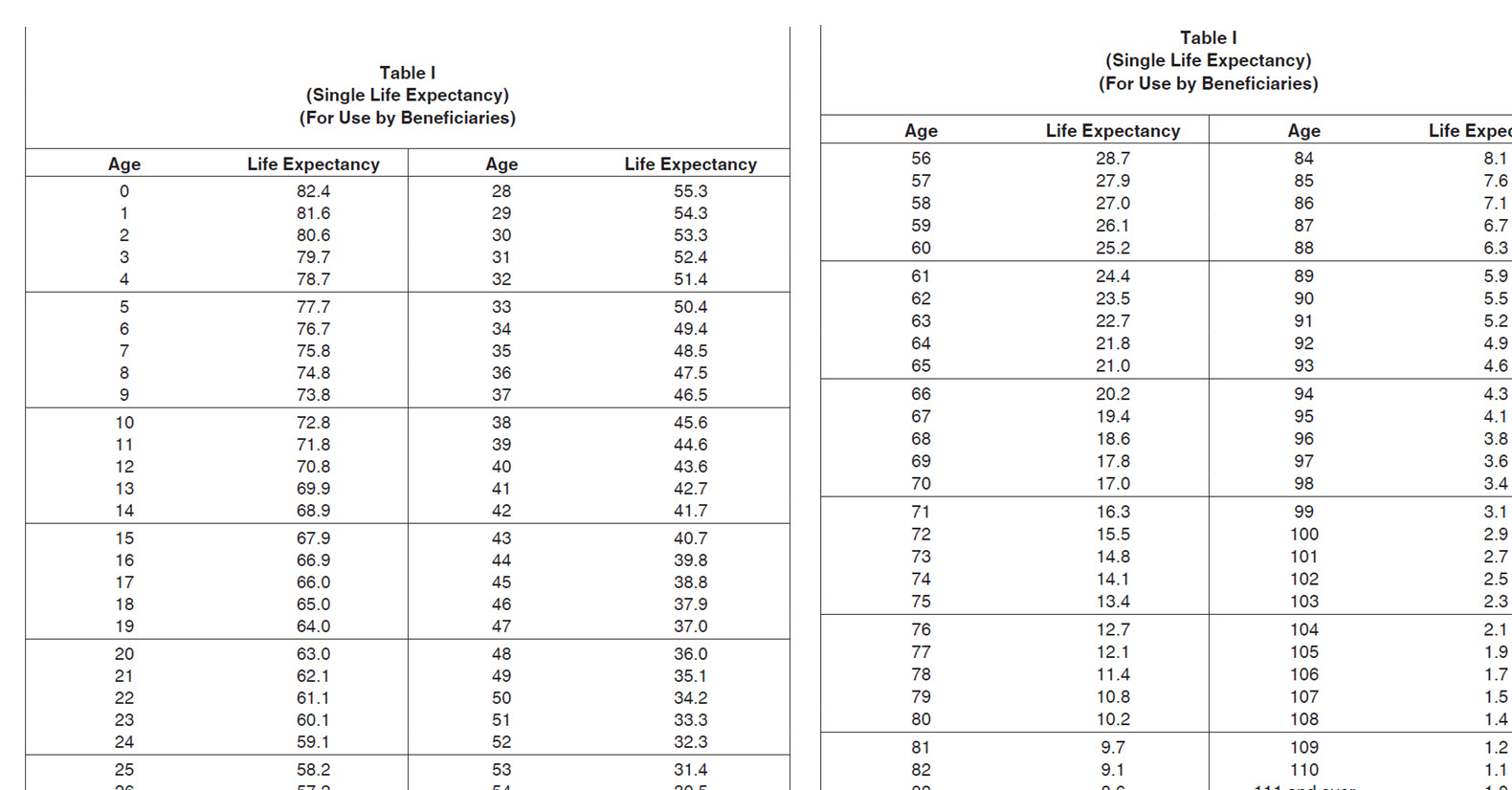

Here is the rmd table for 2024, which is based on the irs’ uniform lifetime table, which is the most widely used table (it is table 3 on page 65).

Posted in 2024